Free User

- 1 model stock portfolio updated monthly against sharing your recommendations

- top favourites of one risk class

- A collective asset allocation

- An investment horizon

- Monthly updated recommendations

Premium Membership

- 5 model stock portfolios updated weekly even without sharing your recommendations.

- top favourites of five risk classes

- Asset allocation once per risk class.

- 4 Investment horizons per risk class.

- Weekly navigation among portfolios.

- Monthly updated recommendations

- *Special Offer

Professional Trader Membership

- 5 model stock portfolios updated daily even without sharing your recommendations

- Real- time signals in case of portfolio shifts

- Top favorites in 5 risk classes.

- 4 Asset Allocations per Risk class

- 4 Investment horizons per risk class.

- Daily navigation among portfolios.

- Monthly updated recommendations

- *Special Offer

Signal Service

For companies we offer a Signal Service for different investment areas and asset classes. Companies please request for the Signal Service at info@ir-system.eu .

Investment Products

We develop investment products with collective intelligence for companies and product partners. Are you interested? Please contact us! New products are in progress and are presented within a short time.

INTELLIGENT RECOMMENDATIONS GmbH offers Fund/Investment and Insurance Advisory and broking and Products in cooperation with the tecis Ag. Ask for it in a Mail to: info@ir-system.eu

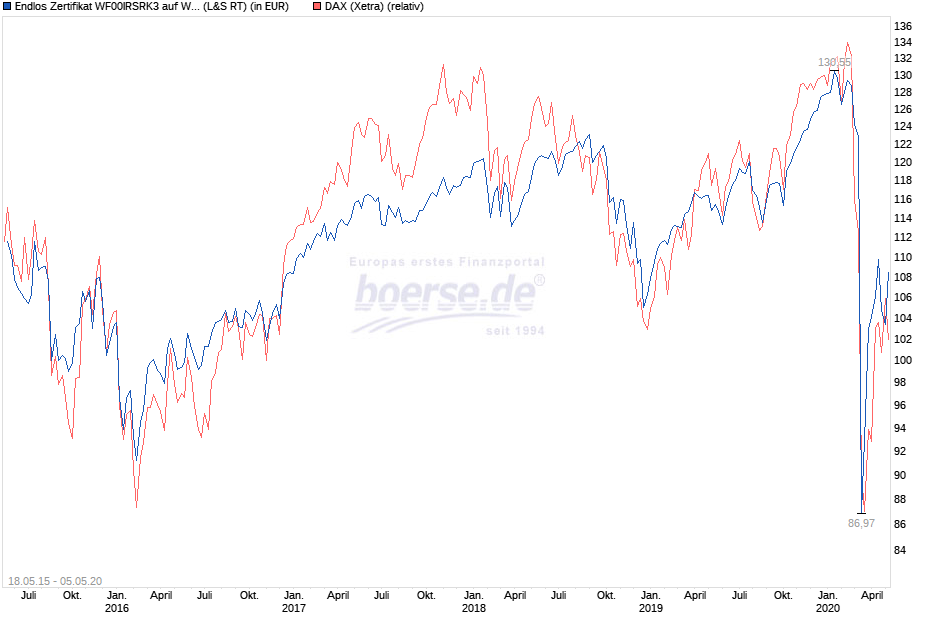

Charts

Charts of Risk Class Index Certificates

Charts from 04th of May 2020

1. Chart: IR-System Risk-tolerant (blue) versus DAX (red)

2. Chart: IR-System Tendency towards risk-tolerant (blue) versus DAX (red)

3. Chart: IR-System Balanced (blue) versus DAX (red)

4. Chart: IR-System Tendency towards risk-averse (blue) versus DAX (red)

5. Chart: IR-System Risk-averse (blue) versus DAX (red)

Index certificates

Our index certificates outperform the DAX up to +1400 percentage points since Emission of the products

10 out of 11 of our active managed products (with Charts) beat the DAX

10 out of 11 of our active managed products (with Charts) beat the DAX

Our model stock portfolios are now displayed in index certificates. One for each risk class. Our index certificates are from now on tradable. At the following Links you find all details of the Index certificates:

1. IR-System risk-tolerant (Link).

Performance at ETF-Costs - Live.

2. IR-System Tendency towards risk-tolerant (Link)

Performance at ETF-Costs - Live

3. IR-System Balanced (Link)

Performance at ETF-Costs - Live.

4. IR-System Tendency towards risk-averse (Link)

Performance at ETF-Costs - Live

5. IR-System risk-averse (Link)

Performance at ETF-Costs - Live

6. Our classic stock product as an Index certificate: IR-Trader (Stock quote 50-400% in average) (Link) Performance at ETF-Costs - Live

7. Intelligent Recommendations manages additionally the KI-Investor (Stock quote: 80-100%) (Link) (a product in cooperation with the Investor Verlag). Here the Performance at ETF-Costs - Live .

An Umbrella-Wikifolio Best of Collective Intelligence (Link) - invests in the best Wikifolios working with collective intelligence. At the moment the Umbrella Wikifolio has an asset allocation of 50% IR-Trader and 50% KI-Investor.

8. A few years ago we initiate the Intelligent Recommendations Index - the IREX, to many users famous as Prediction Index. Now we started the IREX as a product (Link) . Predicted up- and downturns of stocks are shifted with leveraging in the IREX-Index certificate. In first 12 months after emission of the product the IREX outperformed the DAX by more than +1400 Percentage Points.

For US-Stocks Lovers: we have 3 US-Stocks High Performer in the Portfolio:

- IR DowJones-Werte

- IR Nasdaq-Werte

- IR USA

Every US Stocks Product with about +100 up to +170% Performance now in 5 years.

Charts of Stock and Leverage Index Certificates

Charts from 04th of May 2020

1. Chart: IR Nasdaq-Werte (blue) versus Nasdaq (red)

2. Chart: IR DowJones-Werte (blue) versus Dow Jones (red)

3. Chart: IR USA (blue) versus S&P 500 (red)

Literature

We provide selected further reading for you to be able to better grasp the information structures on the markets and the added value you can create through collective intelligence. Our literature recommendations: